How many cryptocurrency projects are really active?

Among the first 100 cryptocurrencies how many are really working? What does it mean for the whole system?

We believe that cryptocurrencies are, in some way, all working or developing projects, with teams behind them working for their implementation. But is this true, or, in reality, even the biggest cryptocurrencies for capitalization are nothing more than gross sketches and general ideas?

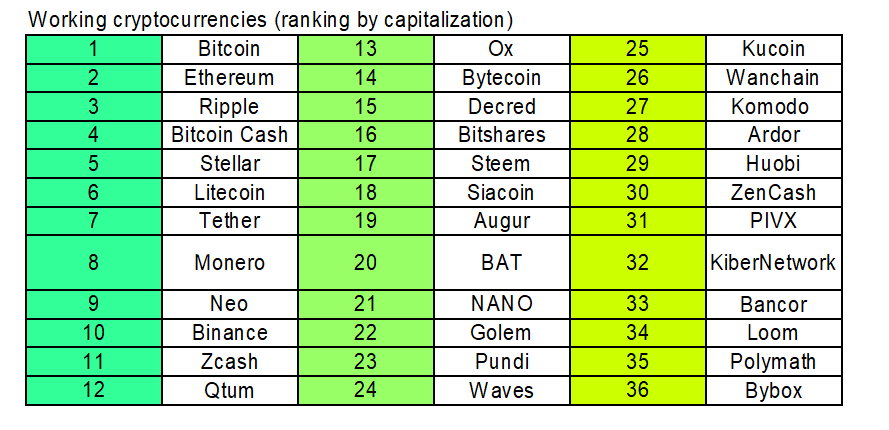

A recent study from Bardinelli and Frumik focused the attention on the fact that, among the first 100 cryptocurrencies ranked by capitalization, only 36 were really working, meaning that they were at least partially fulfilling the premises of their whitepapers.

The researchers were someway rigorous in considering a project as a working one, as many are simply opensource blockchain, so, apparently, they are effective even if not creating any economic value. So in this research not only having working mainnet, with working dApps and smart contracts, was important, but also having a significative use, and being able to create real incomes. The results were not encouraging: considering the first 100 cryptocurrencies, only 36 had some real applications and can be considered effective. Analysing the project composition, we can say that they are mostly historical tokens, with a great experience behind, like Bitcoin, Ethereum, Tether, BCH, Litecoin, Stellar, but going down in the ranking we find some more interesting projects like Neo, the Ethereum from the East, Bitshares, a virtual expression of real and financial assets on the blockchain, Augur, a project on forecast through betting, BAT, a new advertising income sharing tool, and Golem. You can read the whole list in the following table.

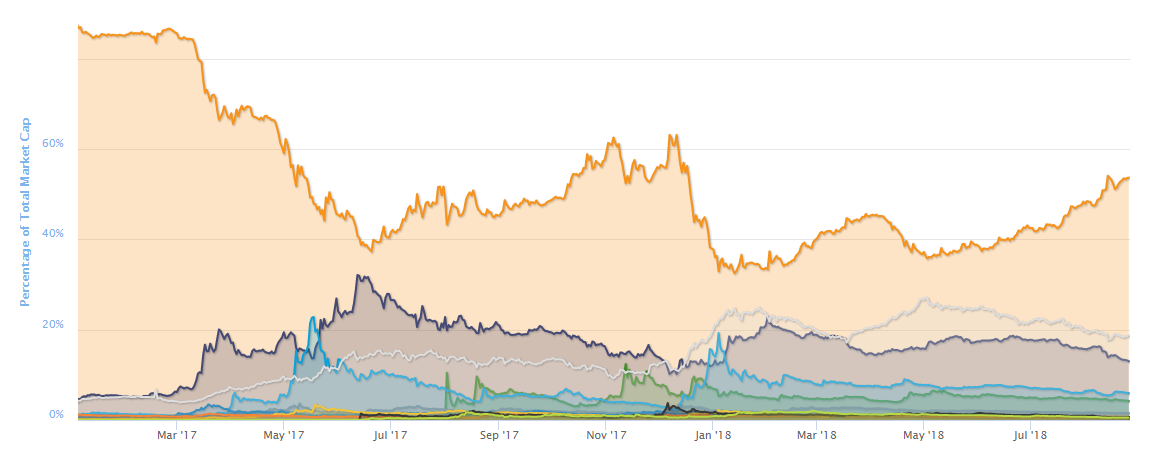

So we know that the majority of the projects is not effective and is not delivering any results. What does it mean for investors? First of all, we should notice that during 2017 we had a step reduction of Bitcoin dominance on the whole Cryptocurrency environment. This was due to the introduction of new tokens which, when having a successful ICO, diminished the weight of BTC while increasing the whole capitalization. Unfortunately, as many projects are not realized in the due time, the capitalization of altcoins shrinks, while Bitcoin, the oldest project, strengthens its position.

(dominance from Coinmarketcap.com: Red BTC, Violet ETH, Blue Ripple; light Blue others)

In the future, it is probable that, following the evolution of High Tech Industry, we will see an increase of the weight in Altcoins. We need only to wait for the time when these projects will realize their expectations, and it is not even said that today tokens will be the market makers of tomorrow. The only road to success passes through a continuous and attentive analysis of the projects, and there is no other easy way.