What is the fundamental value of Bitcoin? Let’s enrich Hans Hauge’s approach

What is the fundamental value of Bitcoin? What is the basic minimum value that we can consider the index of overvaluation or undervaluation of the cryptocurrency? Hans Hauge, expert of this field, in a series of articles published on Seekingalpha, tried to give the answer to this question, elaborating a methodology for evaluating this important basic value in a field signed by a huge volatility.

The Hauge’s system is founded on three essential elements:

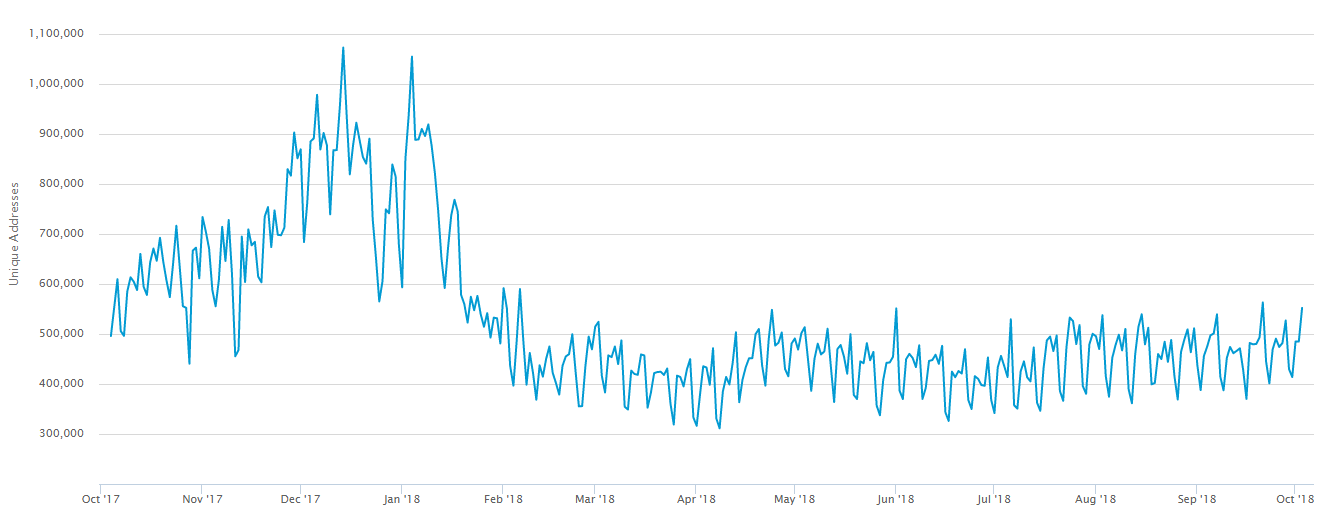

- The number of unique addresses of Bitcoin, which is used to measure the dimension of the network and is able to show the value of the crypto asset according to the Metcalfe Law;

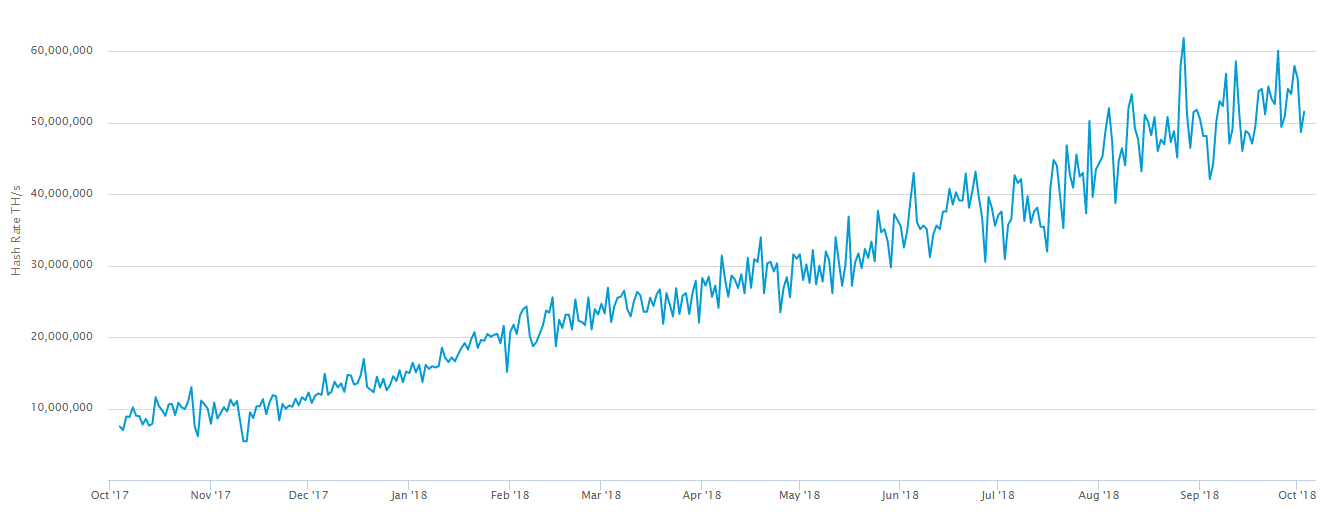

- Hash rate of the network, which is an effect of the medium and long-term investment;

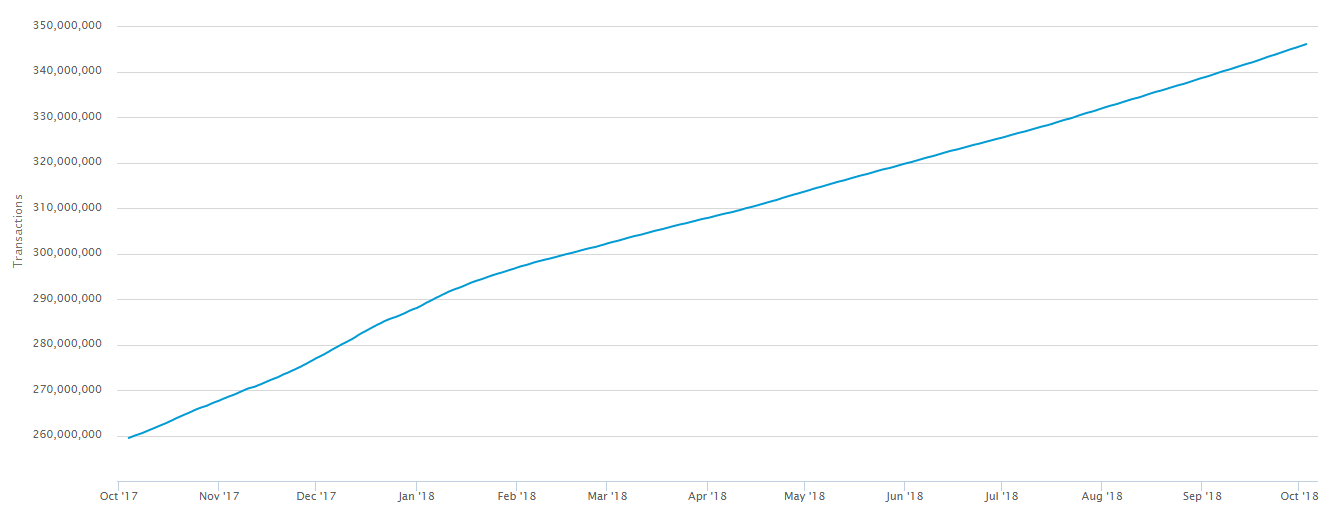

- The total transaction number in the blockchain, which is a meter of the real use of the blockchain.

Each of these indicators has its own weak points:

- The first could be distorted by batching and consolidation in the network;

- The second can be strained by technological advances in computing, and by the time lag between investments and their accomplishment;

- The third can falsely show a strong fall in value, as Gresham Law could even bring a slight increase in the usage. Beside this also the introduction of alternative transaction tools like Lightning Network could decrease the meaning of this indicator.

How have these indicators acted in 2018? Let’s analyse the data from www.blockchain.com

Let’s start examining the Unique Address Number:

Then we can study the movements of the Hash Rate:

And then we can consider the number of transactions:

Now we can compare these graphics with the quotations of Bitcoin in the same time period:

Two on three indicators are fast-growing, following an opposite path if compared with the valuation of BTC on exchanges. This countertendency can show that we are near to the basic, “real” value of Bitcoin, even if this is only a general, qualitative evaluation. We need to make these indicators evolve in two directions:

a. First of all introducing real statistical and quantitative method for giving the right weight to each indicator;

b. We also need to add, in some way, the transaction in the Lighting Network, and this will become more important as it will be able to support more transactions.

This kind of assessment can be used for any other cryptocurrency, when we have this essential data from their blockchains, so we can appraise the spread between the real value of the token and the market one.